work in process inventory formula

Work in Process Inventory Formula. And C c cost of goods completed.

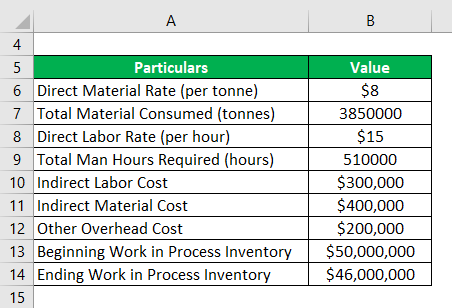

Cost Of Goods Manufactured Formula Examples With Excel Template

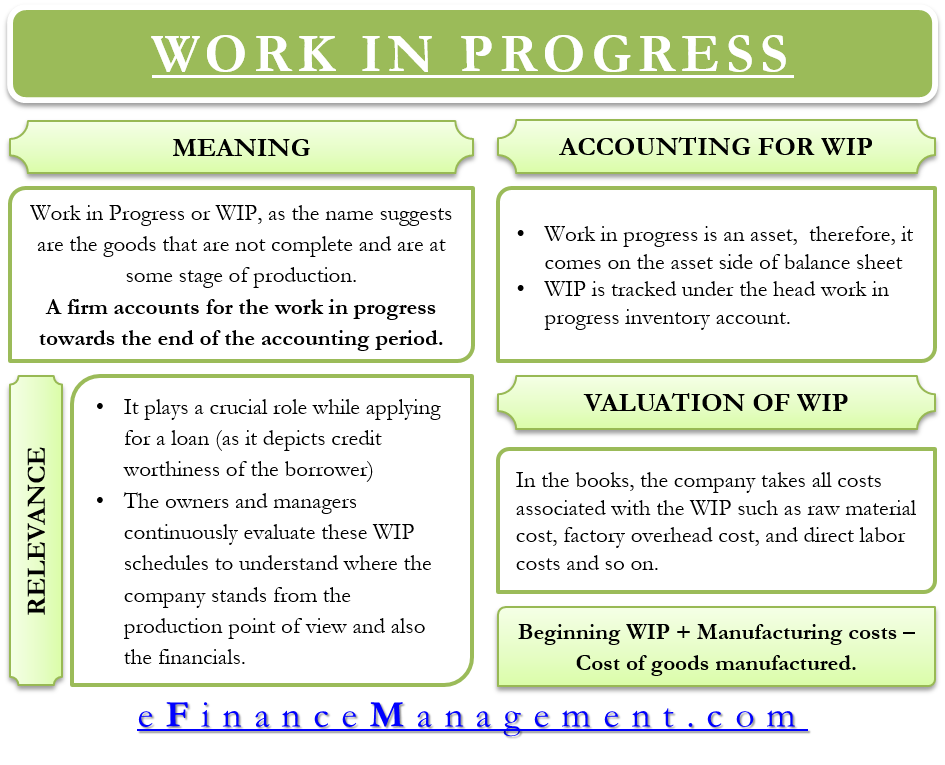

Relevance and Use of Cost of Goods.

. Add the new purchases and subtract the Cost of. Work in process inventory calculations should refer to the past quarter month or year. Formulas to Calculate Work in Process.

Keep in mind this value is only an estimate. Works in process WIP are included in the inventory line item as an asset on your balance sheet. In this formula COGM cost of goods manufactured.

Once you have all three of these variables the formula for calculating WIP inventory is. The work-in-process inventory account is an asset account that is used to track the cost of the partially finished goods. In this example the beginning work in process total for June is 50000 the manufacturing costs are 200000 and the cost of goods completed is 170000.

Pretend you own a hat brand and your store has a. All The Advanced Features You Need To Run Your Business At A Fraction Of The Price. The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process.

How to Calculate Work-in-Progress. Take A Free Product Tour. The formula is as follows.

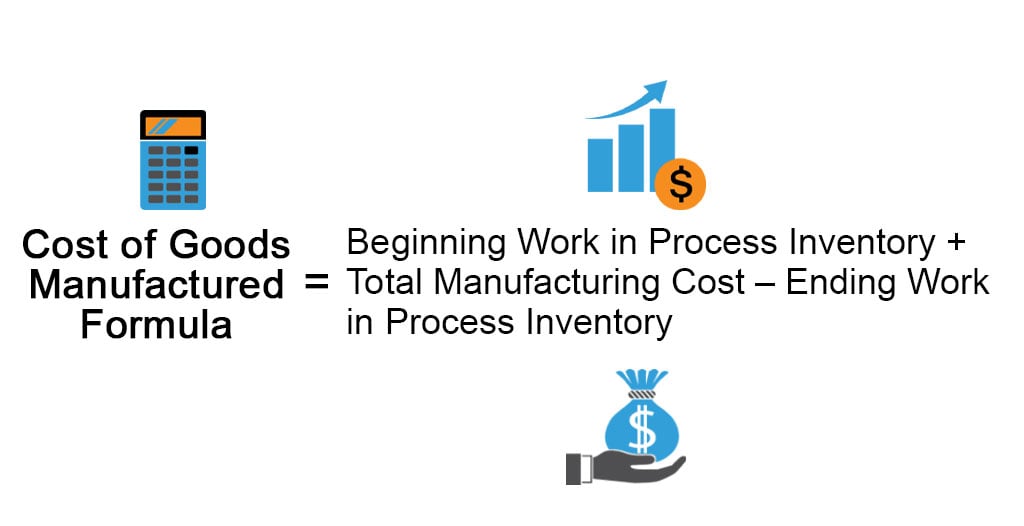

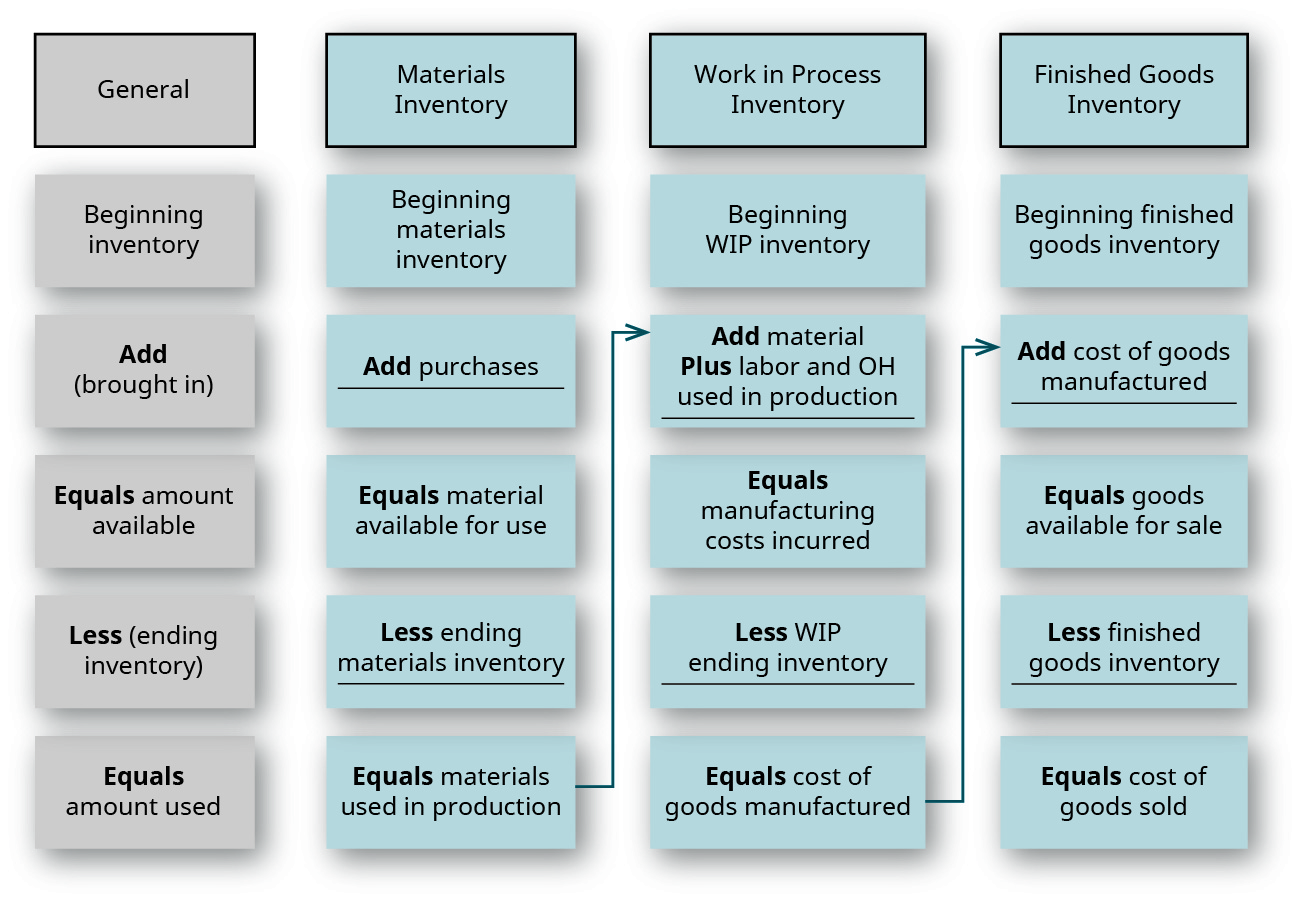

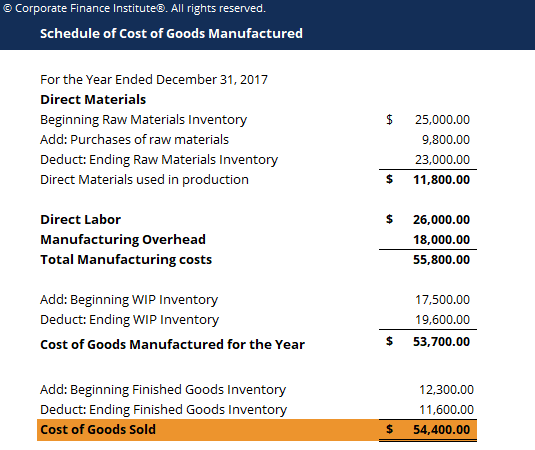

The formula for calculating the WIP inventory is. Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. Heres how youll need to do it.

Manufacturing Price x Quantity Purchases. Beginning WIP Manufacturing costs - Cost of goods manufactured Ending work in process. Work in Progress Inventory Formula Initial WIP Manufacturing Costs Cost of Goods Manufactured Costs - Cost Of Goods Manufactured Cost of Goods Manufactured Formula is value of the total inventory produced during a period and is ready for the purpose of sale.

Example of the Ending Work in Process Calculation. Therefore the formula from which a business can calculate their COGM using work in process inventory costs can be displayed like this. Ad Powerful Business Software Doesnt Need To Break The Bank.

WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS. The formula for calculating WIP inventory is. The amount of ending work in process must be derived as part of the period-end closing process and is also useful for tracking the volume of production activity.

Take A Free Product Tour. Work in process inventory formula. Every dollar invested in unsold inventory represents risk.

For the exact number of work in process inventory you need to calculate it manually. Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. The calculation of ending work in process is.

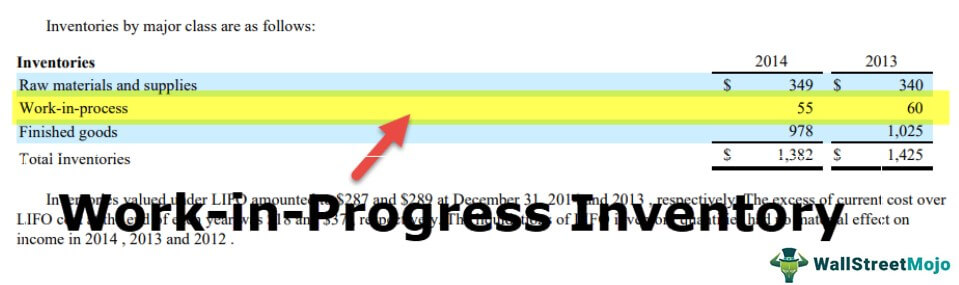

Beginning WIP Inventory Manufacturing Costs Cost of Finished Goods. Work-in-process is an asset and so is aggregated into the inventory line item on the balance sheet usually being the smallest of the three main inventory accounts of which the others are raw materials and finished goods. C m cost of manufacturing.

Ending WIP inventory beginning WIP inventory manufacturing costs COGM. WIP b beginning work in process. And changes in volume of production and inventory levels also tend to be small.

The work in process formula is. Work in process inventory formula. Where there is opening work-in-progress in a process that is not the first stage of the production process the following special consideration is required.

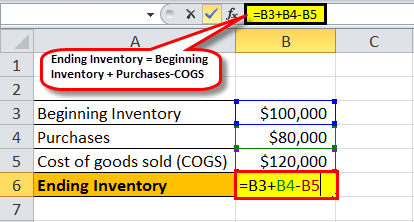

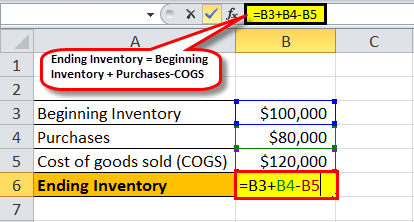

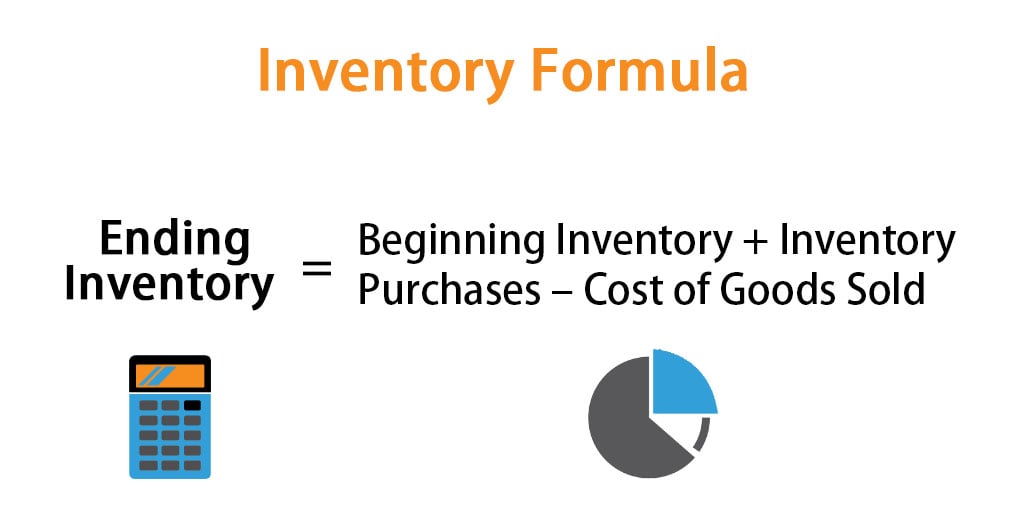

It is generally considered a manufacturing best practice to minimize the amount of work-in-process in the production area. Ending Inventory Beginning Inventory Inventory Purchases Cost of Goods Sold. It doesnt take into account waste scrap spoilage downtime and MRO inventory.

Once youre able to determine your beginning WIP inventory and you calculate your manufacturing costs as well as your cost of manufactured goods you can easily determine how much WIP inventory you have. After the beginning WIP inventory is determined along with the manufacturing costs and the COGM its easy to calculate the amount of WIP inventory that you currently have. How to Calculate Ending Work In Process Inventory.

Imagine BlueCart Coffee Co. Beginning WIP Inventory Production Costs Finished Goods Ending WIP Inventory. How do I account for work in progress inventory.

8000 240000 238000 10000. However by using this formula you can get only an estimate of the work in process inventory. Lets use a best coffee roaster as an example.

Ignoring work in process calculations entirely. The term is used in. In this equation WIP e ending work in process.

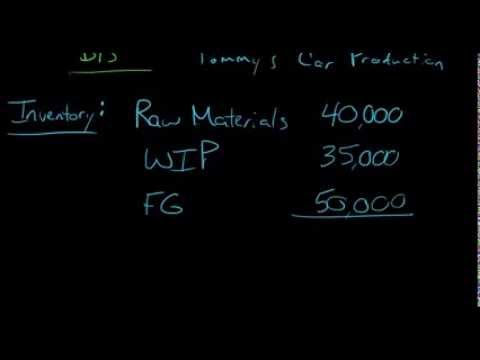

The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process. Definition Formula And Examples Charisma Motors is a commercial car manufacturer specializing in sedans cross-overs and SUVs. WIP Inventory amount Beginning Work in Process Inventory Manufacturing Costs Cost of Manufactured Goods Work in Process VS Work in Progress.

Ending WIP Beginning WIP Costs of manufacturing - costs of goods produced. Work-in-process WIP inventory turns This asset management measure is typically calculated as the cost of goods sold COGS for the year divided by the average on-hand work-in-process material value ie. Work in process inventory 60000.

So to calculate ending inventory for the period we will start will the inventory which is currently listed on companys balance sheet. This means that Crown Industries has 10000 work in process inventory with them. Total Cost of Manufacturing Beginning Work in Process Inventory Ending Work in Process Inventory Cost of Manufactured Goods.

The WIP figure indicates your company has 60000 worth of inventory thats neither raw material nor finished goodsthats your work in process inventory. Work-in-Process Inventory Formula. Take a look at how it looks in the formula.

The value of all materials components and subassemblies representing partially completed production at plant cost for the most recently. Work In Process Inventory Wip. Has a beginning work in process inventory for the quarter of 10000.

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods. Vehicles within the manufacturing plant move along an assembly. Once you know your beginning WIP inventory manufacturing costs and COGM you can start to use the WIP inventory formula.

Cost Of Goods Manufactured Formula Examples With Excel Template

Ending Work In Process Double Entry Bookkeeping

Ending Inventory Formula Step By Step Calculation Examples

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Work In Progress Meaning Importance Accounting And More

Finished Goods Inventory How To Calculate Finished Goods Inventory

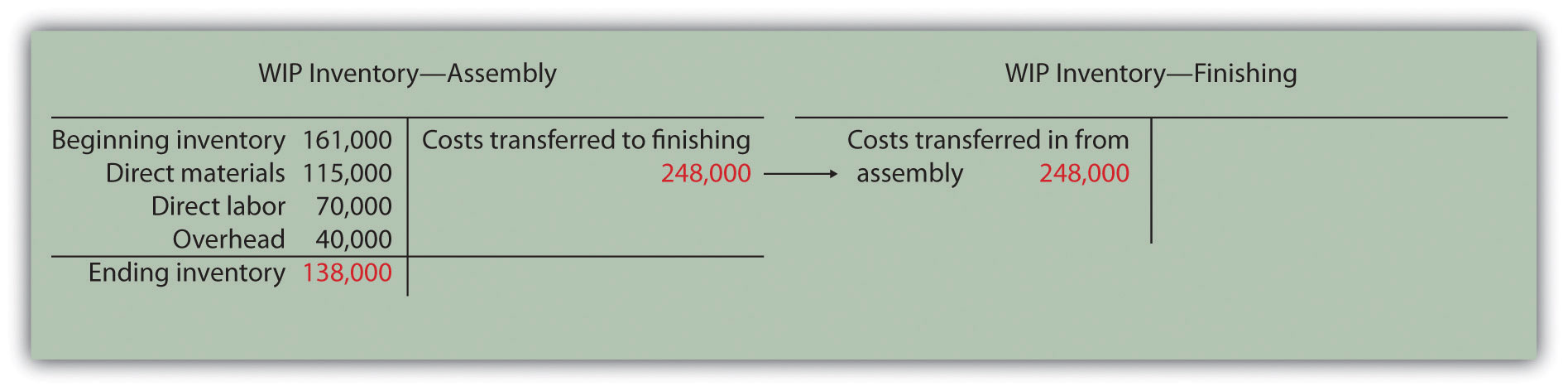

Use The Job Order Costing Method To Trace The Flow Of Product Costs Through The Inventory Accounts Principles Of Accounting Volume 2 Managerial Accounting

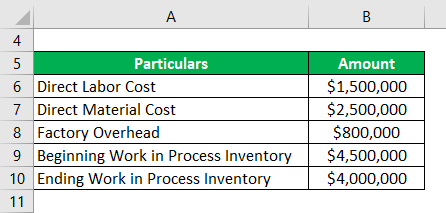

Cost Of Goods Manufactured Formula Examples With Excel Template

Wip Inventory Definition Examples Of Work In Progress Inventory

How To Calculate Ending Inventory The Complete Guide Unleashed Software

Cost Of Goods Manufactured Cogm How To Calculate Cogm

Work In Process Wip What Is Wip

Manufacturing Account Format Double Entry Bookkeeping

Inventory Formula Inventory Calculator Excel Template

Work In Process Wip Inventory Youtube

3 Types Of Inventory Raw Materials Wip And Finished Goods Youtube

What Is Work In Process Wip Inventory How To Calculate It Ware2go

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com